Bitcoin was the name on investors’ lips by the end of 2017, the cryptocurrency soaring 14-fold in 12 months of volatile trading.

But it was also a good year for traditional investments, with US and European markets hitting new highs. Further signs of improvement in the global economy proved a positive factor, while Wall Street was boosted by Donald Trump pushing through his business-friendly tax reforms.

Investors even took in their stride the gradual withdrawal of the central bank measures which have been supporting markets for years now – low interest rates and bond buying programmes. A spate of year-end mergers, not least a $66bn (£49bn) bid from Disney for 21st Century Fox, helped lift sentiment.

In the UK the FTSE 100 hit a new closing peak of 7,687, climbing 7.63% over the year despite early underperformance thanks to worries about Brexit negotiations. Unfortunately our share tips for the year turned in a virtually flat performance overall, down 0.28%.

We had some star performers, including Diageo which added 29%. The Guinness, Smirnoff and Veuve Clicquot drinks group continued to benefit from the fall in sterling since the referendum, given that just 10% of its revenue is generated in the UK.

Mining company Randgold Resources rose 15.5%, as the gold price had its best year since 2010. Card Factory, up 16.6%, proved retailers could do well if they found the right niche.

But there were also some disappointments, notably regional airline Flybe. It issued a profit warning, blaming higher than expected maintenance costs on its fleet and a £10m hit from the fall of sterling since the Brexit vote.

Pharmaceutical group Shire was also a notable faller. It suffered from production problems at one of its best selling drugs, Cinryze, and from investors turning cooler on the whole pharma sector.

So after hits and misses in 2017, here are the Guardian business desk’s share tips for 2018:

EasyJet

Few of the big transport groups appeal: dropping passenger numbers have made rail franchises weigh heavily, while overdue reform on local buses could mean that cash cow can no longer be milked.

Airline stocks have soared in recent years – then sunk with oil rising and the pound slumping. But political uncertainty is now priced in for airlines, while Monarch’s collapse has reduced competition. EasyJet, at £14.64, had barely relocated operations to Austria to prepare for Brexit before it started intoning, like a Teutonic avenger, that only the strong would survive. Gwyn Topham

888

After GVC and Ladbrokes revealed they were in merger talks, bets are being placed on the next gambling industry tie-up. It’s a bit of a toss-up between William Hill and 888 but any predator or prospective merger partner has a clearer sight of the latter.

Unlike bookmakers, its takings won’t be affected by looming regulatory changes to fixed-odds betting terminals. 888, now 281.7p, has shown its appetite for a deal, teaming up with Rank to propose a three-way merger with William Hill. The presence on its share register of several major holders could be a sticking point but it still seems a racing certainty for some kind of value-creating deal in 2018.

Rob Davies

SSE

With price caps on the horizon and tough competition from new entrants, one of the big six energy firms might seem an odd share tip. But with the price now at a relatively low £13.20 after politicians spent a year bashing energy companies and threatening new regulations, things are looking up for SSE.

Lately, the company has been winning in the switching wars. The firm’s networks and generation arms are reliable cash machines. The cherry is that shareholders will own two-thirds of the (likely) more competitive energy supplier born out of SSE merging its retail business with Npower.

Adam Vaughan

Prudential

The insurer, 1905.5p, remains a good pick in its sector. It is one of the leading insurers in Asia, where business is booming (the Pru is in the top three in nine of the 12 countries it operates in).

With a push across China, the new chief executive of the Pru’s Asian arm believes Asia can double earnings again over the next five to seven years.

The roll-out in Africa continues and in the UK, the Pru and M&G insurance and investment arms have merged. In the US, uncertainty around new rules may affect sales of variable annuities but long-term opportunities in the fee-based adviser market look good.

Julia Kollewe

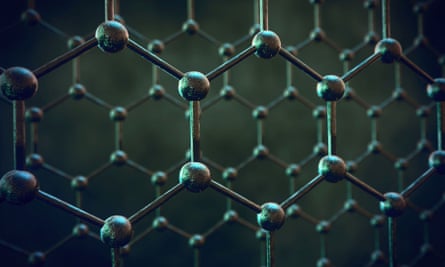

Applied Graphene Materials

Graphene was punted as the next big thing a few years back. A one-molecule-thick layer of graphite that is 20 times stronger than diamond and conducts electricity 20 times better than copper, graphene was hailed as a revolutionary material which could be used in everything from medicine to manufacturing.

So one of the specialist companies in the field, Applied Graphene Materials, saw its shares soar when it joined AIM at the end of 2013.

But turning technology into commercial applications takes time and its shares have since dropped to new lows. The company has now improved its production processes and its building up orders, as well as boosting its balance sheet with a fundraising in October. One to watch at 42p.

Nick Fletcher

BP

Buying shares in oil companies isn’t the best long-term investment, given the damage to the planet from fossil fuels and the gradual shift toward renewable energy and electric cars.

But 2018 could be a good time to own a stake in BP, 522.7p, as it recovers from the depths of the 2014 oil price shock and the Deepwater Horizon disaster.

The British oil major has lagged its peers, but next year, there are favourable winds as it comes through a rough patch. Demand for oil is strong amid resurgent growth in the eurozone and China, while Opec is keeping a tight lid on production, limiting supply.

Be warned though, weaker growth in China or a resurgent US shale industry could have a negative impact, while there are also potential headwinds from rising tensions in the Middle East.

Richard Partington

Footasylum

In a fortnight we’ll find out how trainers and hoodie retailer Footasylum fared in its first Christmas as a listed company.

In October the retailer debuted on Aim at 164p and has so far climbed to 252.5p. With tough times predicted for retailers in 2018 Footasylum’s management team has delivered for investors before with founders David Makin and John Wardle also the creators of JD Sports.

Footasylum is run by Clare Nesbitt, Makin’s 30-year-old daughter, who has worked for the family firm for eight years. With annual sales of £147m the company has great expertise in young branded fashion and sees scope to expand from 56 to 150 stores.

Zoe Wood

ITV

ITV has just signed Gary Neville as a new football pundit. But let’s not hold that against the company’s shares.

The former England defender has joined for the 2018 World Cup, meaning he’s got a decent chance of enjoying his longest ever run in a major international tournament.

While England may routinely disappoint at these jamborees, the broadcaster’s shares tend to do quite nicely during World Cup years, presumably buoyed by ad revenues.

In 2014, England crashed out in the group stages (under assistant manager Nev), but ITV’s shares finished the year around 10% higher. In 2010, when England did (very marginally) better, ITV investors played a blinder, booking profits of 30%.

Can the shares, currently changing hands at around 165.5p, go on a run again? Some City pundits seem to think so, with Goldman Sachs, Citigroup and Morgan Stanley all supporters.

Simon Goodley

Allied Minds

It has been a bad year for famed stock picker Neil Woodford, and one of his worst performers has been Allied Minds.

The UK-listed but US-focused company invests in trying to convert academic and US government science and technology research into money-making companies. Unfortunately, not one of its investments has hit the big time and the company has raked up huge losses and lost its long-serving chief executive.

But Woodford, who owns nearly a third of the shares has always said this was a long-term play, remains committed and with the shares off 80% in less than three years it could be worth a punt at 165p.

Rupert Neate

The Gym Group

As much a New Year’s resolution as a share tip, but the Gym Group seems well placed to take advantage if the population sticks to its vows to look after itself in 2018.

The business is a low-cost operator with no long-term contracts – which can be a turn-off when considering the bigger operators – and charges of about £20 a month. The growth strategy is to add between 15 and 20 sites per year to an estate of nearly 80 gyms.

This is the sort of business that would be vulnerable to a downturn, because gym-going is discretionary particularly if there is no long-term contract. But members of pricier clubs could trade down to the Gym Group if they start to feel the pinch. It might be worth working up a sweat over shares priced at 220p.

Dan Milmo

Comments (…)

Sign in or create your Guardian account to join the discussion